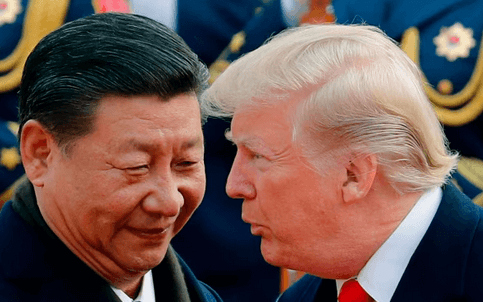

The U.S. and China — the two biggest economies on the planet — are in London right now, sitting down to talk trade, tech, and sanctions. On the surface, it seems calm. But don’t be fooled — behind the scenes, it’s tense.

Here’s what’s riding on this meeting:

Global Prices: Trade shifts could push inflation up or down.

Supply Chains: Everyday products from phones to cars could be affected.

Tech Dominance: AI chips and rare earth minerals are on the line.

What’s Heating Things Up in the US–China London Meeting

Even though both sides are keeping things diplomatic, there are two major pain points in these talks:

- Rare Earth Minerals

China controls a massive chunk of the world’s rare earth supply — the stuff used in EVs, smartphones, and defense tech. The U.S. is trying to reduce its dependence, and Beijing doesn’t like that one bit.

- AI Tech and Chip Exports

The U.S. has banned the export of high-end AI chips to China. It’s a move to stay ahead in the tech race, but it’s also hurting American chipmakers. In response, China’s talking about cutting off U.S. access to critical materials.

Bottom line: Neither side wants to blink first.

What’s at Stake Globally

This US–China London meeting isn’t just about the U.S. and China. It affects everyone:

✅ If they reach a deal: Tariffs might ease, and global markets could calm down.

❌ If talks fall apart: More sanctions, higher prices, and tech disruption.

🤝 If they find middle ground: A temporary pause in the trade war — for now.

Other countries like India, Vietnam, and even the EU are watching closely. If the U.S. and China split supply chains, those regions could see a manufacturing boom.

How This Could Affect You

Whether you’re a tech worker, investor, or just buying groceries, this meeting matters:

🧠 Tech folks: Be ready for chip shortages or export changes.

🛒 Consumers: Prices could jump if tariffs increase.

📈 Investors: Markets are already reacting — especially tech stocks.

The Bottom Line

This isn’t just another summit. The US–China London meeting could set the tone for the next decade of global trade and tech.

One wrong move? It could trigger a deeper economic rift. One smart compromise? It could stabilize markets and open new trade paths.