Monday, November 24, 2025, was a day of pressure for the stock market. Both the Sensex falling and Nifty closed lower for the second consecutive session, clearly impacting investor sentiment. Selling pressure prevailed across large-cap, mid-cap, and small-cap sectors, while the absence of any major positive trigger further exacerbated the market’s weakness.

Global uncertainties and a potential delay in the US-India trade deal kept sentiment negative. While strength in IT and banking stocks provided some relief, the overall sentiment remained cautious and pressured.

Markets remain in the red for the second consecutive day – Sensex falling 331 points, Nifty slips below 26,000; pressure on mid- and small-cap stocks also persists:

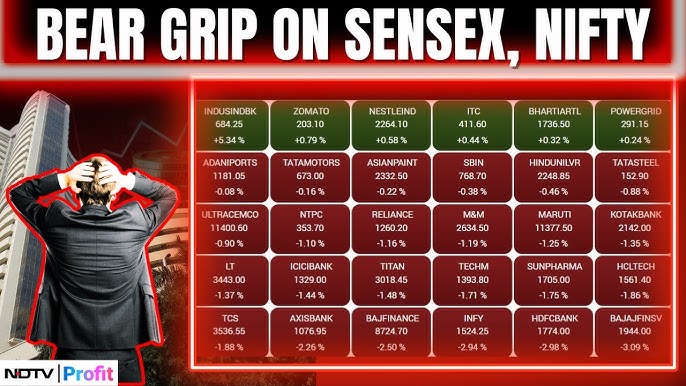

Monday, November 24, 2025, was not an easy day for investors in the stock market. The Sensex falling 331.21 points, or about 0.39%, to close at 84,900.71, while the Nifty 50 also fell 108.65 points (0.42%) to 25,959.50. This was the second consecutive day that the market closed in the red. Not only large-cap indices, but both mid-cap and small-cap indices also came under pressure—mid-caps fell by about 0.27% and small-caps by about 0.83%.

Profit-booking, uncertainties, and a lack of triggers derailed market momentum—realty and metals remained subdued, IT provided some relief; Nifty slipped below the 10-EMA, raising signs of short-term weakness:

Several factors appeared to be at work behind this market weakness. Sensex falling after the recent surge, investors were clearly inclined to book profits, and the lack of any major positive triggers dampened market sentiment. Additionally, global and domestic uncertainties—especially fears of a delay in the US-India trade deal—continued to weigh on investor sentiment.

Sectorally, realty, metals, and consumer durables witnessed the most pressure, although the IT sector managed to stem the decline somewhat. Technical indicators were also not strong—the Nifty failed to hold above 26,000 and closed below the 10-day EMA, suggesting short-term weakness.

Select stocks held firm amid volatile conditions—BEL, M&M, and Tata Steel remained subdued, while IT and banking stocks provided relief; watch for Nifty support, invest strategically:

Seeing stock performance, Bharat Electronics declined nearly 3%, while Mahindra & Mahindra, Tata Steel, and UltraTech Cement also remained in the red. On the other hand, some IT and banking stocks, such as Tech Mahindra, Asian Paints, Infosys, Adani Ports, Sun Pharma, and HDFC Bank, maintained gains, providing partial support to the market.

Further signals are mixed. If Nifty loses support at 25,850, further declines are possible in the near term, but global cues—such as expectations of an interest rate cut by the US Federal Reserve—could also provide a positive bias in the market.

For now, investors should avoid emotional decisions—neither excessive fear nor excessive hope. Market volatility is elevated, so it would be wise to remain cautious in weak sectors, seek opportunities in strong sectors, and maintain portfolio diversification.

Market message is clear: fluctuations will occur, but stable sectors and a balanced portfolio will provide protection:

In the current circumstances, the market is clearly indicating that investors should avoid hasty or emotional decisions. Nifty holding the support level of 25,850 will be crucial for future direction—a slip below this level could deepen the decline, while expectations of softening global interest rates could be a strong trigger.

At this time, reducing exposure to weak sectors and seeking opportunities in stable, strong sectors like IT and banking would be a better strategy. A diversified portfolio and patience will ensure investors survive the volatility in the coming days.