The landscape of Fed monetary policy 2025 is more complex than ever. Traditionally, the Federal Reserve based its decisions strictly on economic data — inflation rates, employment numbers, and GDP growth. However, recent political developments, especially the imposition of tariffs and ongoing geopolitical tensions, have introduced new layers of uncertainty and volatility.

The Shift in Fed Monetary Policy 2025: From Data-Driven to Politically Influenced?

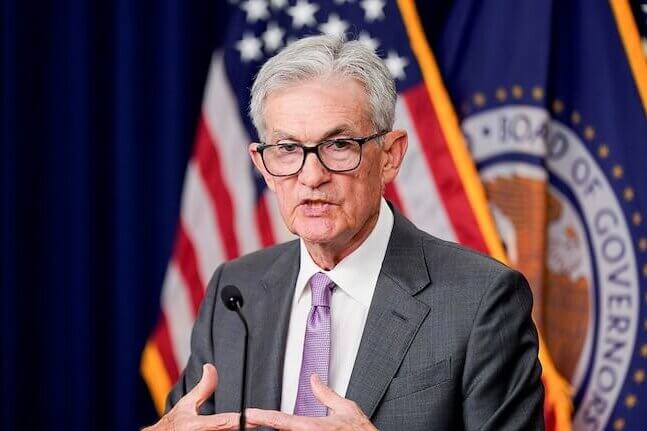

For decades, the Federal Reserve has emphasized a data-driven approach to monetary policy. But in 2025, Fed Chair Jerome Powell has repeatedly warned about increased “volatility” in the economy, suggesting that decisions are no longer based purely on economic numbers.

This shift is largely due to political factors outside traditional economic models. The tariffs introduced by the current administration, coupled with global trade tensions, are impacting inflation and supply chains in ways that are difficult to predict using historical data alone.

How Tariffs and Political Pressures Are Shaping Fed Monetary Policy 2025

Tariffs have caused spikes in production costs and disrupted supply chains, which in turn push prices higher. These external shocks create an environment where economic indicators fluctuate rapidly, making it challenging for the Fed to maintain its usual steady policy course.

Additionally, political pressures play a role. The Fed faces scrutiny not just from markets but also from political leaders who want specific policy outcomes. For example, criticism from former President Trump during the 2024 elections about interest rates has put additional pressure on the Fed to balance economic realities with political expectations.

Why This Matters for the Economy and Investors

The evolving nature of Fed monetary policy 2025 means investors and businesses face more uncertainty. Interest rates might stay higher longer despite some data suggesting they could be lowered. This cautious stance reflects the Fed’s concern over political volatility and unpredictable external shocks.

For consumers, this may translate to slower growth in wages and higher borrowing costs for a longer period. For markets, it means preparing for more fluctuations as the Fed adjusts its approach to manage both economic and political risks.

Conclusion

The Fed is navigating a tricky path in 2025. While it remains committed to data, Fed monetary policy 2025 increasingly factors in political risks and external uncertainties. This dual approach aims to protect the economy from shocks but also raises questions about the Fed’s independence and long-term credibility.