In recent months, crude oil production rising has become a significant trend in the global energy market. While the common narrative attributes this rise to growing global demand, the reality is much more complex. The forces behind this production surge span beyond basic economics—they include geopolitics, technology, debt pressure, and even currency strategy.

Global Demand Recovery and Seasonal Trends

Let’s start with the basics: global demand for oil is recovering. Countries like China are seeing industrial rebounds post-COVID, and with the summer travel season approaching, transportation fuel consumption is expected to rise. This naturally signals oil producers to pump more, resulting in crude oil production rising to meet demand.

OPEC+ and Their Balancing Act

OPEC+ isn’t just reacting to demand—they’re playing a strategic long game. When oil prices climb too high, it fuels global inflation and cuts consumption. If prices crash, exporting countries lose vital revenue. So by gradually increasing output, OPEC+ is attempting to keep the market balanced while avoiding extreme price swings. This careful adjustment is contributing to the crude oil production rising trend across the globe.

Oil as a Political Weapon

Beyond economics, oil remains a powerful geopolitical tool. Countries like Saudi Arabia and Russia use oil production not just for income, but as leverage in global diplomacy. By adjusting output, they can pressure importing nations to negotiate on their terms—a form of “energy warfare” that doesn’t require bullets, just barrels. This geopolitical strategy is another driving force behind crude oil production rising.

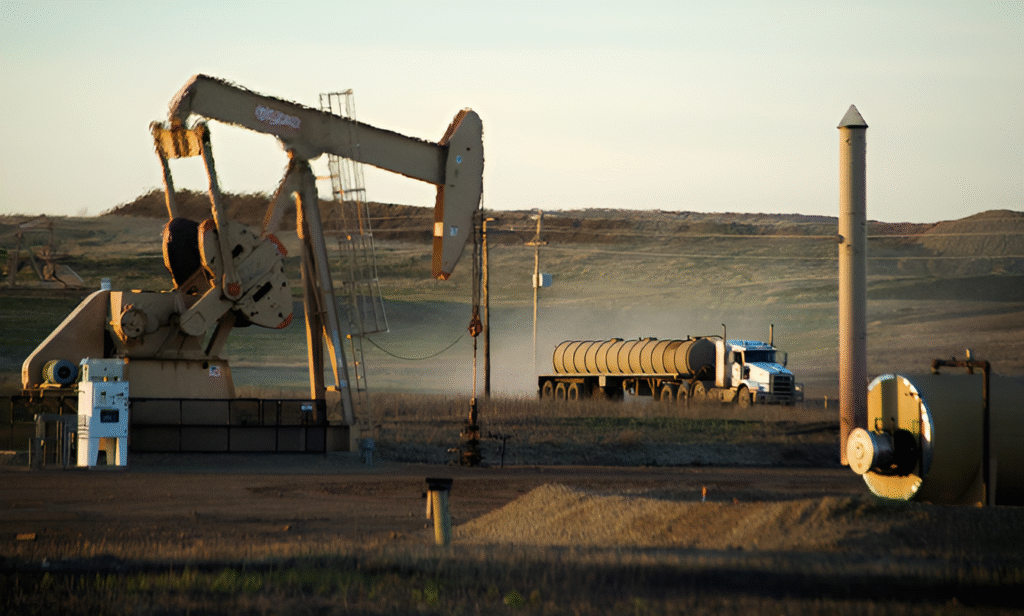

Technology-Driven Production Boom

What’s often overlooked is how tech is changing the game. Digital oilfields, AI-powered monitoring, IoT, and automation are making extraction cheaper, faster, and more efficient. Fields once considered unviable are now back in business, thanks to smart tech. This silent revolution is quietly driving up global supply and further contributing to the trend of crude oil production rising.

Debt-Driven Output from Struggling Economies

Let’s not forget the economic pressure. Countries like Nigeria, Venezuela, and Angola took on massive debt during the pandemic. With repayment deadlines looming, these nations are ramping up oil production—even at lower prices—to generate revenue. For them, it’s not about market timing; it’s survival. This push for survival is one of the key reasons for crude oil production rising in these regions.

The Petrodollar Factor

Oil is traded in U.S. dollars, so increased production drives up global demand for the dollar. This indirectly supports the dollar’s dominance in global finance. In fact, some believe that U.S.-aligned nations quietly encourage oil output increases to help maintain dollar supremacy—a subtle but powerful incentive in global strategy. As a result, the push for crude oil production rising may also have underlying currency-driven motivations.

Final Thoughts

Crude oil production rising isn’t just because the world needs more fuel. It’s driven by a complex mix of geopolitics, economic pressure, tech innovation, and currency influence. Understanding this full picture is key—not just for traders and policymakers, but for anyone looking to grasp how the world runs on oil, power, and influence.